Fundamental Analysis

What do you need to know about stock fundamentals?

Source: Daily Mirror

Overview:

Stock fundamentals matter because analyzing stock fundamentals is a method of determining a stock's real or "fair market" value.

Various fundamental factors can be grouped into quantitative fundamentals and qualitative fundamentals.

On the stock quotation page in Moomoo, there are multiple ways to learn about a company's fundamentals.

Why do stock fundamentals matter?

In the previous sections, we talked about famous stock investors like Warren Buffet and Peter Lynch. They are also notable followers of value investing.

Someone might ask: what is value investing?

The concept of value investing is pretty simple: you buy stocks for less than their underlying values.

While the concept is simple, it is not easy to figure out the value of a company.

So that's why stock fundamentals matter——Analyzing stock fundamentals is a method of determining a stock's real or "fair market" value.

What are the stock fundamentals?

The various fundamental factors can be grouped into two categories: quantitative and qualitative.

Qualitative Fundamentals

The qualitative fundamentals are less tangible.

They might include the quality of a company's key executives, its brand-name recognition, patents, and proprietary technology.

It's also important to consider a company's industry: customer base, market share among firms, industry-wide growth, competition, regulation, and business cycles.

Quantitative Fundamentals

Quantitative fundamentals are the measurable characteristics of a business.

That's why the biggest source of quantitative data is financial statements. Revenue, profit, assets, and more can be measured with great precision.

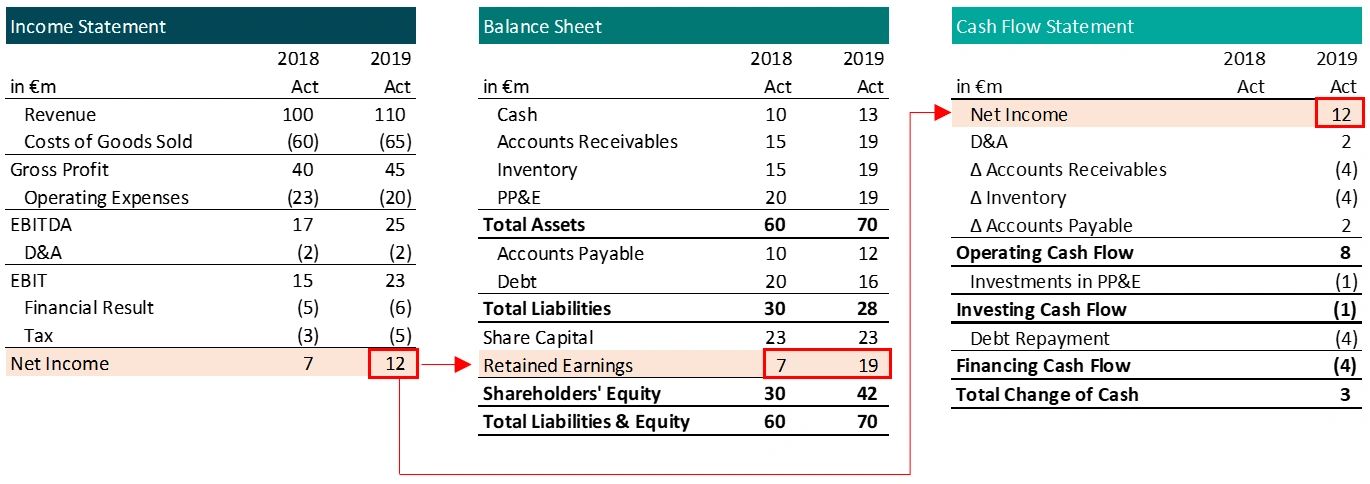

The three most important financial statements are income statements, balance sheets, and cash flow statements.

The balance sheet represents a record of a company's assets, liabilities, and equity at a particular point in time.

While the balance sheet takes a snapshot approach in examining a business, the income statement measures a company's performance over a specific time frame.

The statement of cash flows represents a record of a business' cash inflows and outflows over a period of time.

How to access stock fundamentals on Moomoo?

Since qualitative fundamentals are more difficult to be observed directly, here we will focus on how to access the quantitative fundamentals of a stock.

Step 1: Search for the stock and go to the Quotation page.

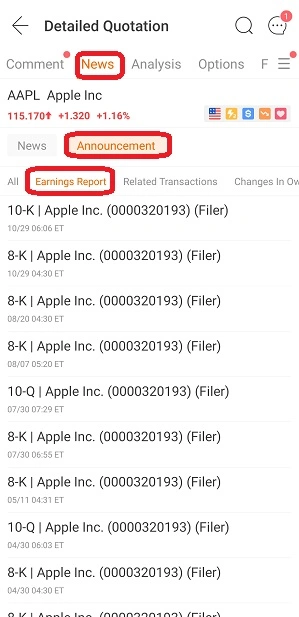

Step 2: Click 「News」,「Announcement」 and 「Earnings Report」

You will find those financial statements in these files.

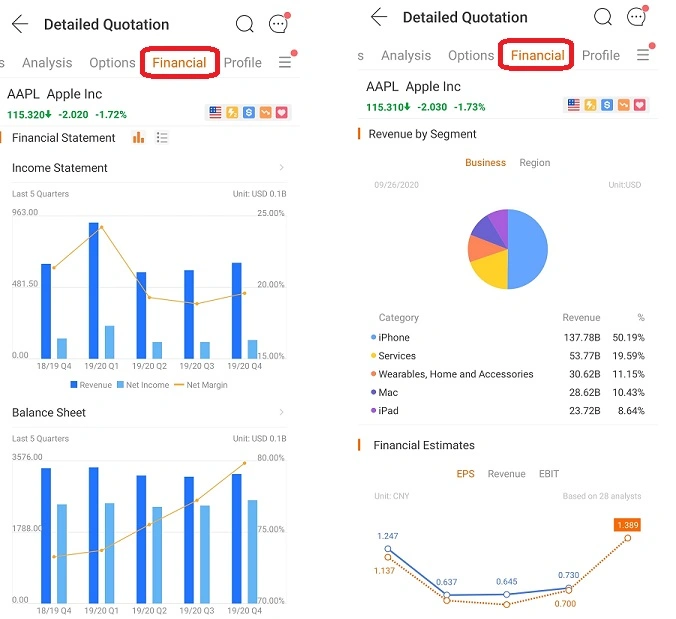

If you think the earnings report is too much for you, here is the other way:

Simply click 「Financial」 and you will be able to have a quick viewing of the stock's fundamentals.