Deciphering Earnings of Big Names

[4.2024]Inside Amazon's earnings: three essential areas that should not be overlooked

Inside Amazon's earnings: three essential areas that should not be overlooked

Among the tech giants in US stock market, Amazon is perhaps the only company recognized as a leader in two major industries. Amazon's financial performance is highly anticipated as a dual powerhouse in both the e-commerce and cloud computing sectors.

On April 30th, after the US stock market closes, Amazon will release its latest earnings report. How do we interpret Amazon's financial results? What are the key areas of focus? In this article, we will mainly examine three key points: the performance of its core retail business, its cloud business, and free cash flow.

1. Core business: retail operations

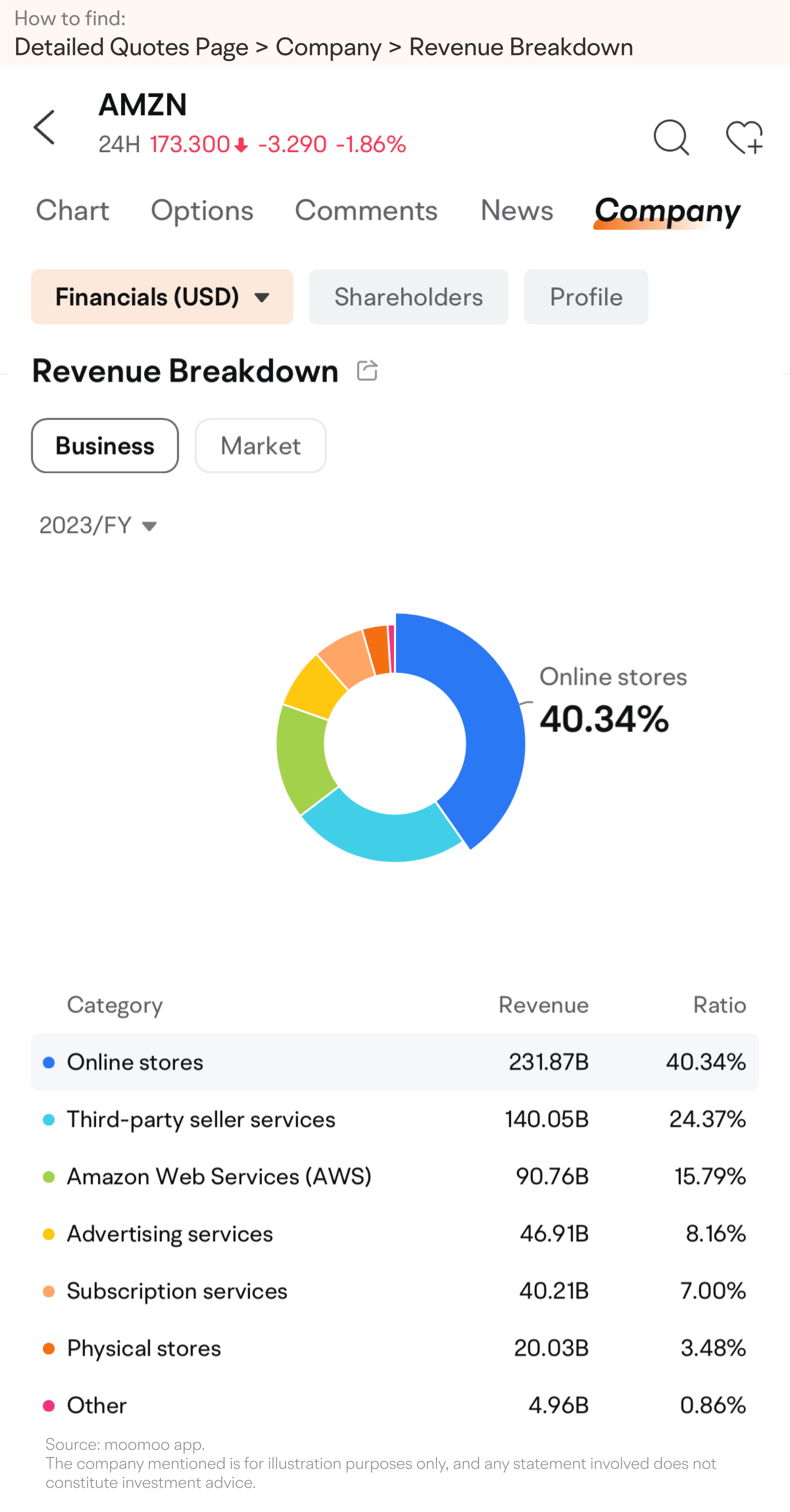

Amazon is commonly known for its e-commerce business, which has expanded to include offline retail, third-party seller services, subscription memberships, and e-commerce advertising. These are all part of Amazon's retail operations, forming the company's core business.

For retail operations, revenue growth rate and profit margins may be the key indicators to watch. In recent years, Amazon's retail revenue has been volatile due to the pandemic and macroeconomic volatility. However, from 2020 to the first half of 2021, the pandemic boosted online shopping demand, and the Federal Reserve's loose monetary policy fueled macroeconomic growth. As a result, Amazon's retail sector experienced year-over-year(YoY) growth rates of over 40% in some quarters.

Starting in the second half of 2021, as the pandemic began to ease and economic growth expectations declined due to Federal Reserve interest rate hikes, Amazon's retail revenue growth rate showed a sharp drop.

However, in the first half of 2023, economic growth expectations in the US improved, and with a low revenue base, Amazon's retail business rebounded, returning to double-digit growth in Q2. Amazon's retail revenue growth rate reached 12.6% and 14.0% in Q3 and Q4 2023, respectively, indicating a strong rebound. As we look ahead to the upcoming financial seasons, monitoring whether this growth rate can be sustained may be important.

Regarding profit margins, Amazon's operating profit margin in retail tends to follow the revenue growth trend. During H1 2020-2021, North American retail operations achieved an operating profit margin exceeding 5%, while international retail operations turned profitable. Starting from Q3 2021, Amazon's retail business experienced a significant decline in revenue growth rate. Additionally, economies of scale weakened, and the industry competition intensified due to new entrants such as Tiktok and Temu. As a result, the operating margin saw a steep decline, and its North American branch even began to suffer losses.

In 2023, as economic growth expectations improved and Amazon's cost-cutting measures, such as layoffs, began to take effect, Amazon's operating margin rebounded. The North American retail business margin returned to over 5% in Q4 2023, and losses for international business narrowed considerably.

The growth and profitability of Amazon's retail business in every quarter of 2023 were likely significant contributors to its over 80% stock price increase in 2023. As we look ahead to future financial quarters, it may be important to monitor whether Amazon's retail business can maintain its revenue growth trend and whether its profit margins can keep improving.

2. Growth driver: AWS

Amazon has been focusing on cloud computing since 2006. Currently, AWS cloud services account for more than 15% of Amazon's total revenue and have become the company's core growth point and main source of profits in recent years. Two primary concerns regarding AWS cloud services may be its revenue growth rate and margin.

From the first half of 2022, Amazon's cloud business revenue growth rate began to decline continuously due to companies cutting IT spending. The quarterly year-over-year growth rate decreased from almost 40% to just over 10%. Moreover, its operating profit margin dropped from above 30% to around 24% in Q1 of 2023. However, in Q3 and Q4 of 2023, Amazon's cloud revenue growth rebounded, and the operating margin recovered to about 30%.

Looking ahead to upcoming financial quarters, we may monitor whether Amazon's cloud service revenue growth rate can stabilize and whether the margin can continue to maintain a stable upward trend.

Secondly, it's worth noting the changes in Amazon's market share of cloud services. Amazon dominates the cloud market with a market share of over 30%. However, since the cloud industry is currently experiencing an overall slowdown, a reduction in growth for Amazon is within expectations. While enterprise IT spending may undergo periodic changes, the shift from traditional IT spending to cloud computing may be a long-term trend. Therefore, fluctuations in cloud computing growth rates may not impact its long-term growth potential.

Given this situation, it's important to monitor whether Amazon can maintain its leading market share and solidify its position as the dominant player in the cloud industry.

We have observed that among players with over 10% market share in the cloud computing industry, Microsoft Azure and Google Cloud have grown at a similar rate quarterly for the past two years, both far exceeding AWS's growth rate. This means that although Amazon currently has the highest market share, major competitors have been growing faster and are close behind. We need to keep a watchful eye on the top players' growth and market share changes, and see if Amazon can avoid losing its dominance.

3. Long-term lifeblood: free cash flow

For a long time, Amazon operated at a loss, while other major tech giants such as Apple, Microsoft, and Google were generating profits. It wasn't until 2018 that Amazon achieved massive profits of over $10 billion. Additionally, Amazon has rarely engaged in shareholder returns such as stock buybacks or dividends. However, despite these shortcomings, Amazon's stock price has shown an impressive long-term upward trend in the past, propelling the company into the ranks of trillion-dollar market capitalization giants. A major reason for this may be Amazon's high growth rate and strong free cash flow over the years.

In particular, Amazon's strong free cash flow may be one of the key factors that allowed the markets to overlook its perennial losses and helped it achieve a market capitalization of over a trillion dollars. This is partly because some widely accepted valuation models base a company's value on the present value of its future cash flows. According to the cash flow statements on moomoo, we can see Amazon's free cash flow data for different financial periods.

Throughout the decade from 2011 to 2020, Amazon's net profit was unstable, but its free cash flow remained consistently positive and exceeded net profit every year. While Amazon accumulated around $50 billion in net profits during this period, its free cash flow nearly reached $100 billion.

However, starting from 2021, Amazon's free cash flow has taken a sharp downward turn and has remained negative for two consecutive years, amounting to over $10 billion each year. This may be one of the reasons why Amazon's stock price lagged behind other tech giants in 2021 and even suffered a significant drop in 2022.

One of the primary reasons for this dramatic reversal in Amazon's free cash flow is the substantial increase in fixed asset spending. It could be due to the entry of new players such as TikTok and Temu that intensified competition within the industry, or Amazon investing more heavily in areas like logistics infrastructure to enhance user experience and improve its competitive edge. Despite pouring significant resources into these areas, Amazon's revenue has not continued its high growth rate from previous years. Its fixed asset spending has skyrocketed from a level of billions to over $50 billion, putting enormous pressure on its free cash flow.

The good news is that in 2023, Amazon reduced its capital expenditures and significantly improved its free cash flow, surpassing $30 billion. We still need to monitor Amazon's future financial reports regarding its fixed asset investment and free cash flow, as these are important factors for Amazon's long-term stock price performance.

In summary, Amazon's retail business has been its fundamental backbone, and we may benefit from keeping keep an eye on whether revenue growth and operating profit margins can continue to improve.

At present, AWS cloud services are the main source of Amazon's growth and profits, so it's important to monitor whether revenue growth and profit margins can stabilize over time.

Free cash flow may be a key factor in Amazon's long-term stock price performance, so it may be important to observe whether it can continue to improve in upcoming financial quarters.