Deciphering Earnings of Big Names

[4.2024]Netflix: What to watch in the streaming giant's earnings?

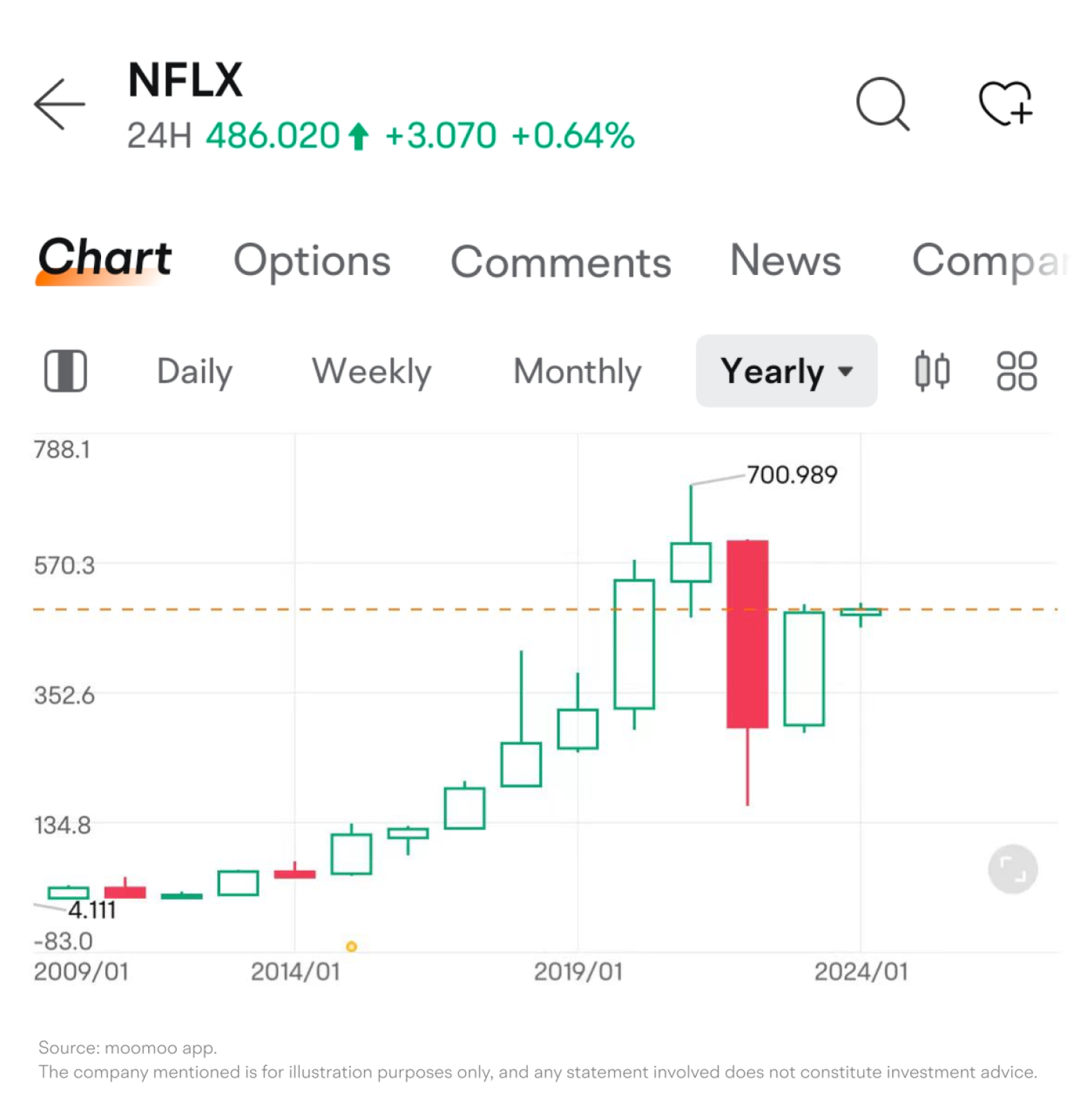

Netflix stands out as a stellar performer in the U.S. stock market, boasting an impressive thirtyfold stock price surge over the past ten years.

As a trailblazer in the streaming media sector, Netflix has reaped the benefits of the industry's explosive growth and is now transitioning to a period of steadier growth. So how should we read its earnings? There are three areas that may be worth observing: revenue growth, investment in content against the cash flow, and the margin.

1. Revenue growth

Netflix has moved past its early years of high-speed revenue growth exceeding 20%. In Q4 2022, the company's year-over-year(YoY) revenue growth slowed to just under 2%, nearly reaching negative growth. Fortunately, in the subsequent quarters, Netflix's revenue growth accelerated, reaching approximately 7.8% in Q3 2023 and returning to double-digit growth with a 12.5% year-over-year increase in Q4 2023. Looking ahead, it's crucial to monitor whether Netflix can maintain this robust rebound in revenue growth. Two key metrics warrant particular attention.

The first metric is the number of paid subscribers. Netflix's business model relies primarily on attracting users to pay for its high-quality video content. The company's earnings are predominantly from monthly subscription fees, and recently, Netflix introduced a lower-priced ad-supported plan, adding advertising revenue to the mix, albeit a small proportion.

Hence, the number of paid subscribers is foundational to Netflix's performance; more subscribers may equate to greater potential revenue. The trend shows that Netflix's paid subscriber base is growing. In Q3 2023, the company added nearly 9 million subscribers compared to the previous quarter, and by Q4 2024, the platform's quarterly net subscriber additions exceeded 10 million, pushing the total number of users to approximately 261 million, setting a new record.

A contributing factor to this increase may be Netflix's policies introduced in 2023 to combat account sharing, compelling some users who previously shared accounts to purchase their own. Additionally, the introduction of lower-priced ad-supported plans in emerging markets has also fueled subscriber growth.

The second metric is ARPU (Average Revenue Per User). A higher ARPU may lead to higher overall revenue. Over the past two years, Netflix's ARPU has fluctuated mostly between $11.50 and $12, with little overall change. Regionally, ARPU has been trending upward in North America, while it declined slightly in Latin America for Q4 2023. In Europe, it has remained steady in the last several quarters. The APAC region's ARPU has been decreasing due to the impact of lower-priced ad-supported plans.

In their Q3 2023 letter to shareholders, Netflix's management highlighted planned price hikes in major markets, including the U.S., U.K., and France, which are expected to boost the average revenue per user (ARPU) in these regions. Yet, there's a risk that higher prices might lead to a drop in demand. Should consumers decide the new prices aren't worth it and start canceling their subscriptions—a phenomenon known as "voting with their feet"—this could negatively impact the platform's subscriber count.

Looking ahead, a key question for Netflix may be whether it can continue adding subscribers at a strong pace. Successfully retaining and growing the subscriber base after raising prices would signal the company's enduring market strength and customer loyalty. However, a marked slowdown or decrease in subscriber numbers as a result of the higher ARPU could suggest a challenging road ahead for Netflix's revenue growth.

2. Investment in content against cash flow

Netflix has been successful in attracting paid subscribers largely due to its significant investments in content. Blockbuster series like "House of Cards" have been crucial to its growth, helping it amass hundreds of millions of paying customers.

However, excessive spending on content can strain Netflix's cash flow and profit margins. Conversely, spending too little risks a shortage of fresh, compelling content to keep subscribers hooked, which could also hurt revenue and profits. Therefore, Netflix may need to balance investment in content with user experience, aiming to maximize subscriber satisfaction, revenue, and profit growth with minimal content spend and cash outlay.

To evaluate Netflix's investment in content, we can look at two indicators: cash spent on content and the size of content assets. Netflix's cash spend on content has been conservative in recent quarters, with six consecutive quarters of year-over-year reduction, including a near 30% drop in Q3 2023.

Regarding content assets, because older content can become less valuable over time, it must be amortized according to accounting policies. As the rate of increase in Netflix's content assets has not kept up with amortization rates, the value of its content assets has trended downward over the last five quarters.

Although Netflix's reduced content investment may negatively impact user attraction and revenue growth, it has significantly improved the company's free cash flow, moving from consistently negative to exceeding net income levels over the last five quarters. With an increase in cash reserves, Netflix, which historically has not repurchased shares frequently, started to buy back shares consistently over the last four quarters, potentially buoying its share price.

In summary, there's a cyclical nature to Netflix's content investment. In the long run, if Netflix can maintain revenue and cash flow growth that outpaces content investment, this could be considered a healthy financial state. Conversely, if Netflix's content investment consistently exceeds its revenue and cash flow growth, it may signal a potential financial risk.

3. Margin

Companies like Netflix, which attract subscribers through heavy content investment, typically experience significant economies of scale. More subscribers and higher revenues can result from the same level of content investment, potentially leading to increased margins. However, the opposite scenario can be problematic: if revenue growth slows while content costs rise, margins can come under severe pressure.

Therefore, Netflix's profitability is intimately linked to the balance between content spending and revenue growth.

Netflix's margins have shown seasonal patterns, and reviewing the year-over-year changes can be insightful. From Q4 2021, as Netflix's revenue growth consistently fell below 20% while content expenditure remained elevated, the company's ability to generate profits was challenged. This resulted in a downward trend in both gross and net margins for six consecutive quarters.

Recently, however, there's been a turnaround. With revenue growth showing signs of a potential revival in recent three quarters and content investments cut significantly for five straight quarters, Netflix's profitability has begun to see an upswing, with both gross and net income margins bouncing back compared to the previous year. Moving forward, it will be important to keep an eye on whether this positive trend in Netflix's margins can be sustained.

In summary:

For revenue growth, it's important to watch how Netflix's subscriber count and ARPU evolve. The challenge is to see if subscriber growth can be sustained alongside increases in ARPU.

Looking at content asset investment and cash flow, Netflix has recently reduced its spending, contributing to better cash flow. However, maintaining a long-term equilibrium between content investment, revenue growth, and cash flow is important.

In terms of profit margins, recent quarters have shown an improvement for Netflix, influenced by both revenue growth and content expenditure. We may need to continue to monitor the longevity of this improvement in profitability.