Learn Premium

Trading Tutorials-Technical Tracking

Price target of $1,500? What happened to Super Micro? (04/17/2024)

Hello, everyone! This week, we are focusing our spotlight on Super Micro Computer $Super Micro Computer(SMCI.US)$, a prominent player in the artificial intelligence (AI) industry. We’ll explore the latest trends and take a close look at the company's recent market activity.

What’s new?

On April 16, 2024, Super Micro Computer’s stock price closed up 10.6% at $976.30, bringing its year-to-date gain to 243%.

This surge was due to a superbullish research note from Loop Capital analyst Ananda Baruah, who almost tripled his stock-price target for the AI hardware provider to $1,500 from $600.

Baruah’s upgraded price target is driven by his heightened confidence in the company’s standing within the AI server sector. He contends that the stock is poised to consistently trade at 20 to 30 times its projected earnings. His price estimation hinges on the expectation that Super Micro will earn between $50 to $60 per share in 2026, alongside anticipated revenues of $30 billion to $40 billion.

Super Micro’s pioneering role in the AI server market has transformed it into a somewhat battleground stock, particularly as its AI server sales rocketed, with a 103% revenue increase last quarter, a significant leap from the previous quarter’s 14.4%.

Bears view Super Micro as having minimal competitive advantages over rivals like Dell and Hewlett-Packard. Bulls, however, contend that Super Micro’s early move into AI servers has granted it overlooked strengths poised to drive long-term growth.

Chart of the day

Trend analysis:

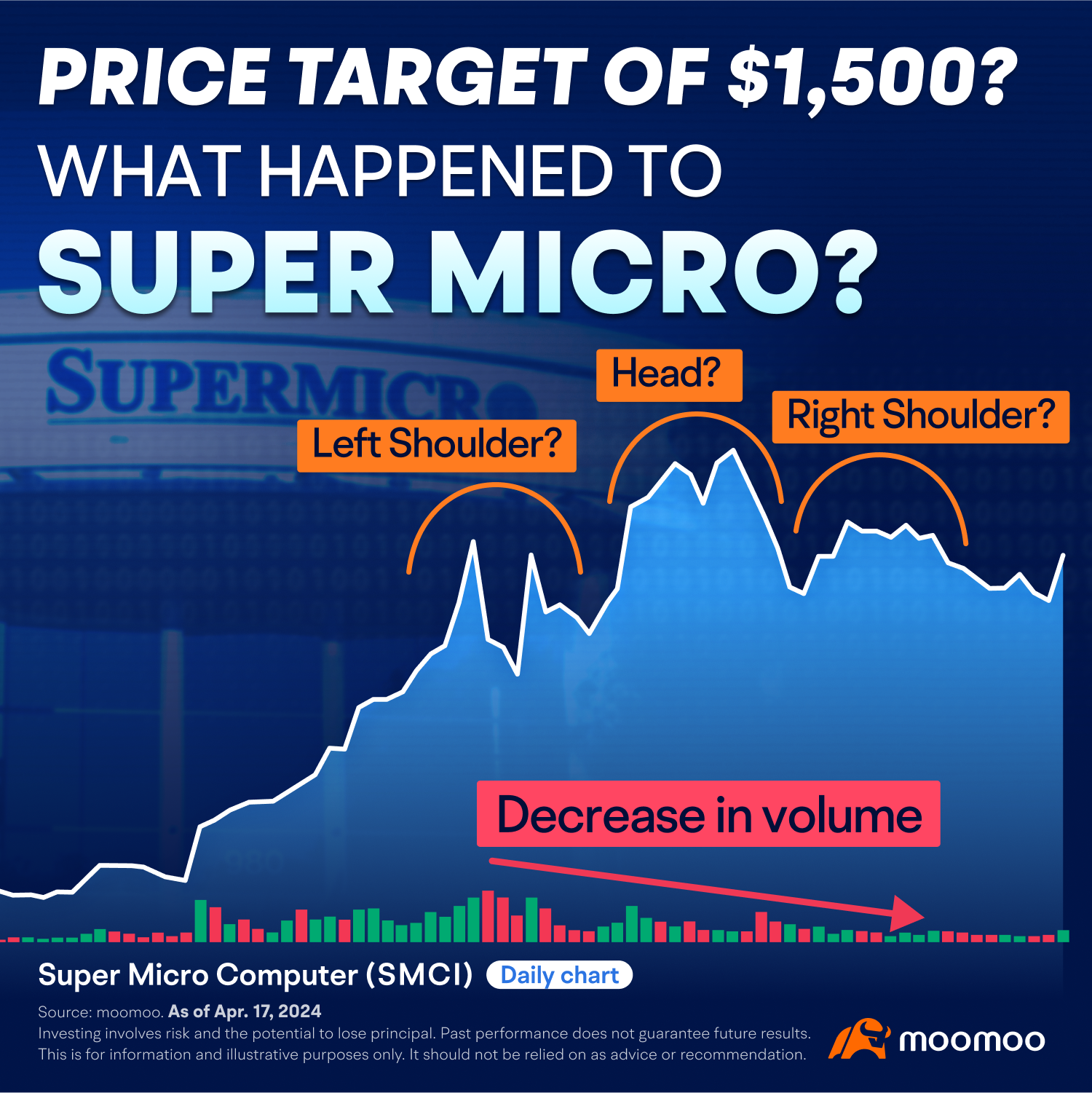

The daily chart below indicates a potential Head and Shoulders pattern on Super Micro Computer (SMCI).

1. In mid-January 2024, SMCI saw a sharp rally, with the price surging over 300% within a month and surpassing $1,000 for the first time, forming a potential left shoulder.

2. The stock pulled back nearly 50% of its prior gains in mid-February.

3. A second rally began, driving the price to over $1,200, forming a potential head.

4. In mid-March, the stock experienced a second pullback, causing the price to fall below $900.

5. The stock made a third advance, but failed to exceed the prior high, and experienced a decline in trading volume, forming a potential right shoulder.

6. Over the following three weeks, the stock moved downward.

Technical indicators:

SMCI has recently traded below the 50-day moving average (MA50) for the first time in three months, prior to the significant jump of 10.6% on April 16, 2024.

The trading volume on the potential head and right shoulder is significantly lower than that on the potential left shoulder, indicating fewer market participants.

Some momentum-based oscillators, such as the KDJ, have been trending downward since mid-February, when the stock price surpassed $1,000 for the first time.

The stock has been trading within two convergence trendlines for a month and a half, suggesting a potential breakout to either the upside or downside.

Next move?

SMCI is trading at a two-week peak with short-term bullish sentiment, bolstered by a significant bullish candlestick on April 16, 2024.

However, a potential Head and Shoulders formation on the daily chart suggests a potential for longer-term weakness.

This presentation discusses technical analysis, other approaches, including fundamental analysis, may offer very different views. The examples provided are for illustrative purposes only and are not intended to be reflective of the results you can expect to achieve.

All investing involves risk, including the potential loss of principal, and there can be no guarantee that any investing strategy will be successful.